There is a non-linear relationship between losses and gains. It is just math. It has nothing to do with wonderful products and services. It has nothing to do with hardworking CEO's. The math is the math. The sooner you realize the mathematical importance of protecting capital, the better your investment results will become. Once your losses exceed a certain level (about 10%), your gains have to exceed your losses to get back to even, e.g. to recover from a 25% loss, a 33% gain is necessary and to recover from a 50% loss, a 100% gain is necessary to recover.

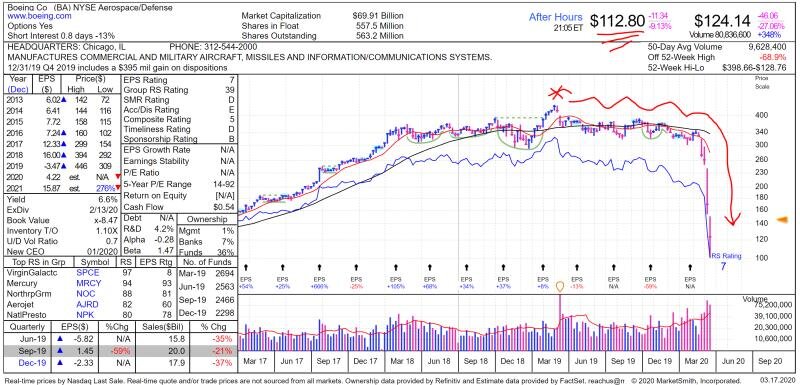

I am showing Boeing (BA) as an example below. I have no interest in Boeing. I am not long or short the stock. It is just an example. BA peaked at $446/share and currently trades about $112. It is a big cap, well know, and liquid company. It is now trading at 75% loss from the high. To recover from this this down move, BA would have to appreciate 300%. While anything is possible, this occurrence has about a 0% probability. This is how capital is destroyed for ever. Have investing rules to protect and grow your capital. 75% of the time, historically, stocks and stock markets are either going down or recovering from going down. You are hurting your results if you do not have a robust sell discipline!