Side bar: I’m going to use terminology that I hate to use such as, bear/bull markets, recessions, bubble, etc. There are emotional attachments to those words and it is important to remain objective, factual, and as dispassionate as possible. For emphasis, I’m going to use these words to make a point.

You invest for what is to come, not what has happened! No one, myself included, knows the future with 100% certainty. Investors biggest challenge is how to deal with uncertainty. Part of what makes investing hard is that you have the media and Humongous Bank and Brokerage, Inc. (HBB), each with no vision, simply telling you stories about the most recent past and extrapolating that into the future. This is called recency bias and is a big no no. These institutions with big megaphones have a massive conflict of interest because they rarely tell you to sell. There is never a way out. But I do find it funny that while they never call the top, they are quite quick to tell you the bottom is in! Wearing the losses all the way down is not calling a bottom, btw. These charlatans haven’t changed in 100 years. This is exactly why I am writing this missive.

I was recently flipping through LinkedIn and I noticed several ads/articles from ahem, competitors, cheering on that the big rally in stocks for July is somehow a sign that the stock market decline has priced in a recession and its time to be more positive on stocks - or something along those lines. I obviously have a different perspective. I could be right or I could be wrong. If I am wrong, I won’t stay wrong and adjust my positioning to reflect new incoming data in context to history and math. Stocks are just bouncing to a lower high in a massive downtrend. To me this is a sell (or sell short), not a buy signal.

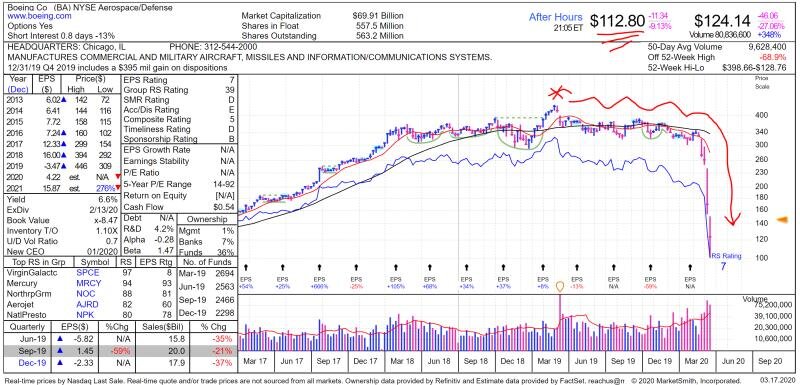

My view: The Fed is in the early stages of bursting the biggest bubble in stocks and real estate - EVER! We are in the very early stages of a massive valuation markdown. This mark down will continue until big companies begin to break. What I mean by break is bankruptcy. The run up in stocks in July is nothing more than a very large short squeeze. (A short squeeze is when institutions that sold stocks short, must close the trade by buying those previously sold shares. The violent move higher is due to speculators pushing shares up in price simultaneously with short sellers buying back the shares to close the trade.) We are in the early innings of a recession. This mark-down process most likely happens over many quarters or even years. Any bubble, not to mention the biggest bubble EVER (did I say that already?) that has been pumped for over a decade, doesn’t get deflated in 6 months. One of the most important things investors need to understand, when this valuation mark-down, bear market, or whatever is finished, the next group of great stock market leaders WILL NOT BE THE PRIOR LEADERSHIP STOCKS. If your portfolio is heavily weighted in Apple, Facebook, Google, Microsoft, Netflix, etc.etc., I’d seriously start thinking differently.

I always corroborate any fundamental view with price. Price is the final arbiter. I am not smarter than price. This is like the old saying that I don’t have to outrun the bear, I just have to outrun you. I have a select set of rules that help me confirm when I am right and get me out when I am wrong. You always want to wait to be the technical buyer meeting the emotional seller or the technical seller meeting the emotional buyer.

The markets always leave a series of clues, but do you have the strategy to act while uncertain? Can you be comfortable being uncomfortable? Do you have the ability to hold two opposing thoughts simultaneously in your head? Can you act bullish while having bearish bias or vice versa? Analysis is easy. The only way to increase your account balance is to execute. When we are required to execute under uncertainty you have to behave in a certain way. When we require behavior all sorts of issues within your brain or past can prevent you from success. People don’t sell high prices because they fear leaving money on the table. People sell at lows because the pain of loss has superseded the hopium of price coming back. I’m not a hopium dealer. Call your Humongous Bank and Brokerage, Inc. rep or your local CFP to give you your fix if that is what you need.

Here are the top 10 things I’d be talking to your spouse or yourself in the mirror:

Do I/we have a technical rules base process to help me risk manage markets

Do I/ we have the investment flexibility that can be applied to a wide variety of asset classes

Do I/we have a daily or weekly review process to help me risk manage my accounts

Do I/we maintain an active watchlist of new and innovative companies

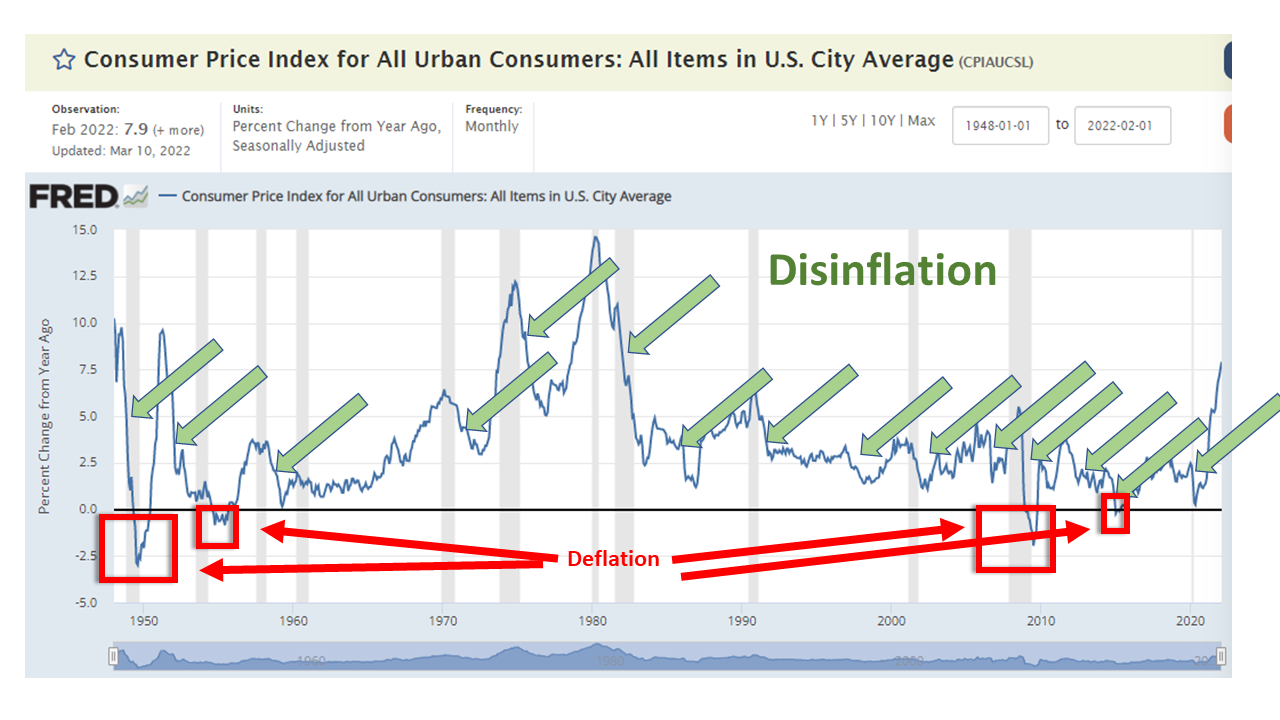

Do I/we have a process to monitor major economic indicators using a rate of change math

Do I/we have a min/max position sizing process of getting in and getting out of positions

Do I/we have a good grasp on the relevant factors that are currently driving order flow

Do I/we have a quantitative process to clearly (like within seconds) tell if an asset is in an uptrend, downtrend, or no trend

Do I/we have 4 distinct investment portfolios that change as the incoming data changes

Do I/we have a process that is adaptive and forward looking or is it a “stay the course” regardless of the data

I know what I do and what my clients expect from me. That is what I’ve outlined above. Markets change. The fundamental view that I have outlined above may not come to fruition. Currently, I believe it will and that many people will be unfortunately financially crushed. I also believe that If I am right and can properly execute on my risk management rules over the next 18 months, there will be generational wealth creating opportunities waiting for us on the backside of all of this. I feel guided to marshal my resources before the coming investment hurricane, so that I am of clear mind to decisively act when the opportunities are presented.

Peace and prosperity,

P. Franklin, Jr., CEO